Give More Clients the Care They Need in the Home They Love.

At AAG, we have helped thousands of homeowners strategically use their home equity to achieve a better retirement. With our wide-ranging home equity solutions, older Americans can customize the right plan for their specific healthcare needs, including in-home care.

Our Goals

- Educate seniors and their families on all funding options available to them.

- Avoid having home care services prematurely or unnecessarily lowered or canceled.

- Reduce financial stress over the ongoing or increasing cost of care for clients and their families.

- Retrofit, remodel, or modify the home for safety, prevention, and other needs.

HECM Borrower Basics

- Must be 62 or better.

- The home must be their primary residence.

- No monthly mortgage payments are required so long as they continue to pay property taxes and homeowners insurance and maintain the home.

- Equity can be accessed several ways – lump sum, monthly payments for life, as a line of credit that can grow over time, or a combination of these for added flexibility.

More AAG options: FHA, traditional, refinance, jumbo, jumbo reverse, reverse for purchase and jumbo reverse for purchase loans.

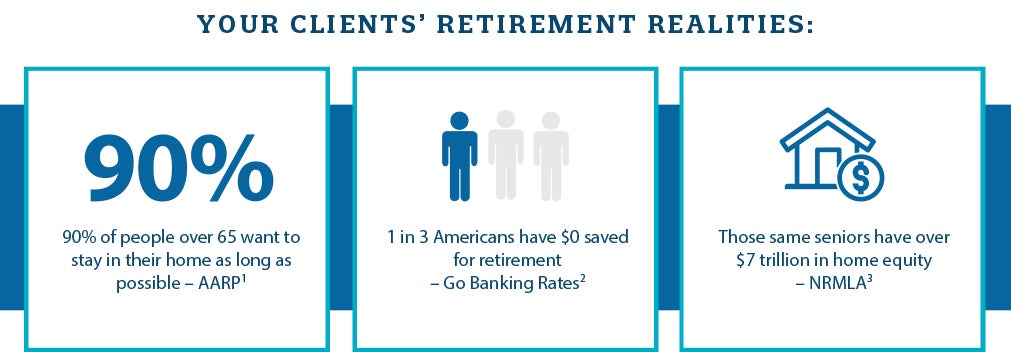

¹https://assets.aarp.org/rgcenter/ppi/liv-com/aging-in-place-2011-full.pdf

²https://www.prnewswire.com/news-releases/1-in-3-americans-has-0-saved-for-retirement-300234464.html

³https://www.prnewswire.com/news-releases/senior-housing-wealth-exceeds-record-9-57-trillion-301400814.html

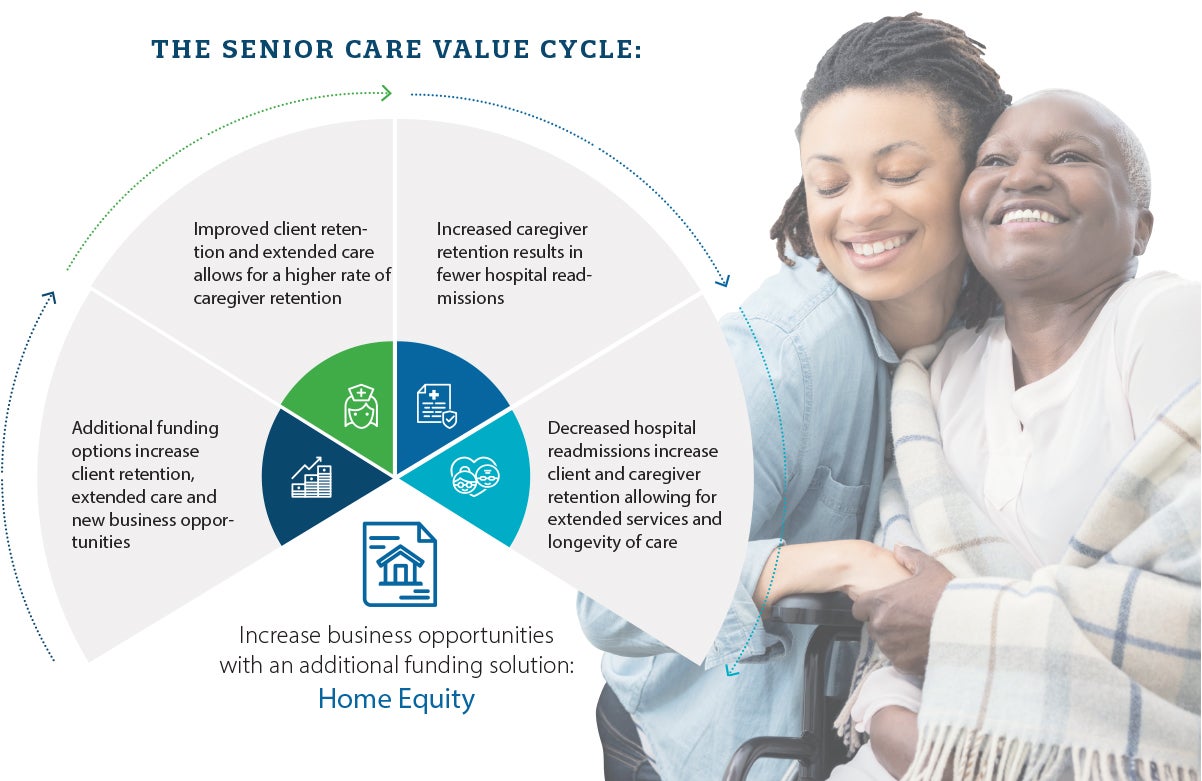

Home equity solutions can help older adults cover the cost of long-term care in the comfort of their home. Learn more about the different options available to your patients.

Case Study: How Seniors Can Use a HECM to Pay for Home Improvements and In-Home Care

Explore the strategic use of the Home Equity Conversion Mortgage (HECM) loan by Christine and Patrick to modify their home and cover the cost of in-home care.

ReadSenior Care Bifold

Learn more about how we are working together to help seniors retire better by leveraging Home Equity Conversion Mortgage (HECM) loans as a solution to funding home care services.

ReadSenior Care Trifold

Learn more about how Home Equity Conversion Mortgage (HECM) loans can be used to supplement the cost of in-home care.

ReadHECM Loan Basics for Senior Care

Learn more about how Home Equity Conversion Mortgage (HECM) loans can be used to supplement in-home and long-term care costs. Explore the different options available to your care recipients. Share this brochure with those who may be able to use this powerful financial tool to stay in the comfort of their own home.

Read

Senior Expert Jim Bland Conducts His Company the Right Way

Offering a Symphony of Services for Seniors Who Want to Age in Place Jim Bland is a special kind of conductor. Instead of directing the simultaneous performance of several players to bring a musical score to life, he is a multi-talented maestro who’s company provides innovative in-home fall prevention technologies and works with expert building […]

Read More

Using a HECM to Fund Home Care

As a senior care professional, you know Medicare provides only limited in-home medical coverage for your patients. It may provide in-home skilled nursing or physical therapy, but it generally won’t cover custodial care. Even if your patients have a supplemental Medicare plan, it will likely not be enough. Using a HECM to fund their home […]

Read MoreCall us today: (844) 395-4374

For industry professionals only – not intended for distribution to the general public.

AAG/American Advisors Group are divisions of Finance of America Reverse LLC which is licensed nationwide | Equal Housing Opportunity | NMLS ID # 2285 | 8023 East 63rd Place, Suite 700 | Tulsa, OK 74133

News & Updates

Senior Expert Jim Bland Conducts His Company the Right Way

Offering a Symphony of Services for Seniors Who Want to Age in Place Jim Bland is a special kind of conductor. Instead of directing the simultaneous performance of several players to bring a musical score to life, he is a multi-talented maestro who’s company provides innovative in-home fall prevention technologies and works with expert building […]

Read More

Using a HECM to Fund Home Care

As a senior care professional, you know Medicare provides only limited in-home medical coverage for your patients. It may provide in-home skilled nursing or physical therapy, but it generally won’t cover custodial care. Even if your patients have a supplemental Medicare plan, it will likely not be enough. Using a HECM to fund their home […]

Read More