Give retired clients the certainty and flexibility they seek.

Did you know, homeowners 62 and up have over $7 trillion¹ tied up in home equity? Helping your clients unlock and leverage some of that home equity as part of an overall retirement strategy can prove a winning move for you and the families you serve. Bring greater balance, diversification, and risk management to the families you serve.

The Challenge

Today, advisors are looking for ways to preserve investments, avoid portfolio losses, secure cash flow and back-up emergency reserves. How can home equity bridge the gap? It’s a financial tool that has been specifically designed for homeowners 62 and older.

The Solution

The Home Equity Conversion Mortgage (HECM) loan is an FHA, government-insured, non-recourse loan on a primary residence, for people at least age 62:

- Borrowers have the option of whether or not to make monthly mortgage payments as long as they continue to live in the home, pay for property taxes, homeowners insurance, and maintain the home.

- The loan becomes due when the home is sold, the borrower changes residence, the last borrower (or eligible non-borrowing spouse) dies, or the last borrower is in a continuing care facility for 12 consecutive months.

- Like any loan, reverse mortgage proceeds are paid out tax-free.

Proceeds from a HECM loan can be distributed monthly, in a lump sum, as a revolving line of credit, or a combination of these. A HECM Line of Credit (HECM LOC) provides access to equity at a predictable growth rate regardless of real estate performance.

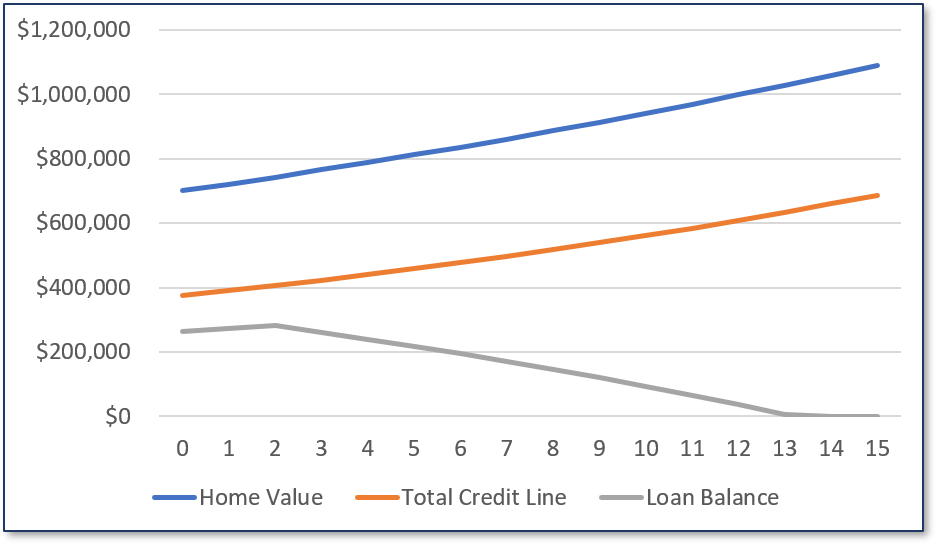

HECM LOC in Action

An eligible couple lives in a home valued at $700,000 and owes $240,000 on their mortgage. They take out a HECM loan which pays off their current mortgage and opens a total credit of $113,200. This line of credit grows over the next 10 years to be worth $467,512. They delay a monthly payment on the loan for 2 years, and then start a monthly payment of $2,600 for a total of $31,200 over the life of the loan.

This example is based on IMIP of $14,000, origination fee of $6,000 and other settlement costs of $2,000. HECM as of 05/12/2020.

Key Outcomes

With a HECM LOC, you and your clients can respond better to market swings. Borrowers can access their loan proceeds during market downturns rather than draw down their investments. Similarly, by using their loan funds to supplement their income, they may be able to delay taking social security benefits until they reach full retirement age.

* * *

More Solutions

High-Value Properties: Clients can access up to $4 million in equity on high-value properties with a proprietary reverse mortgage, AAG’s Advantage loan. There is no mortgage insurance required, no capital gains or income tax on loan distributions³ and all loan proceeds are accessed in one lump sum.

Buying a Home: If you have clients seeking to downsize or move closer to family, friends and more of the lifestyle amenities they enjoy, they can purchase a new home, with a combination of their funds and a HECM loan, also known as a HECM for Purchase.

Funding Home Care: According to The Joint Commission, home care can help many patients achieve optimal health outcomes.² With a HECM, your clients may gain greater financial flexibility over their health care decisions, including the choice of aging and living comfortably in place.

All AAG options: VA, FHA, traditional, refinance, jumbo, jumbo reverse, reverse for purchase and jumbo reverse for purchase loans.

¹"Senior Housing Wealth Reaches Record $7.23 Trillion" - National Reverse Mortgage Lenders Association. April 3, 2020. https://www.nrmlaonline.org/about/press-releases/senior-housing-wealth-reaches-record-7-23-trillion

²“Home-The Best place for Health Care”- The Joint Commission.2011. Web.22 Jan 2016. http://www.johnahartford.org/images/uploads/ resources/Home_Care_position_paper_4_5_111.pdf

³Capital gains taxes are only due upon a sale. A Jumbo Reverse Mortgage is a loan, secured by a mortgage on the home, and does not require sale of the home. The proceeds of a loan are not taxable as income.

The Sequence of Returns

See how you can help your clients manage the sequence of returns risk with the strategic use of home equity in retirement planning.

ReadCase Study: Avoiding the Realization of Capital Gains in Highly Appreciated Stock Positions

Explore the strategic use of the Home Equity Conversion Mortgage (HECM) loan by William and Lorraine after hearing about the Line of Credit product option from their advisor.

ReadHECM Loan Basics for Financial Professionals

Learn more about how Home Equity Conversion Mortgage (HECM) loans can be a powerful solution for your clients who are 62 or better.

ReadIdentifying Opportunities in Home Equity

This flyer explains how to know when a client is a good fit for a Home Equity Conversion Mortgage (HECM) loan. Use this information to have a positive impact on your clients' financial longevity, liquidity, and legacy.

ReadAAG Advantage Loans - Help Clients Access More

Access MORE with the AAG Advantage Reverse Mortgage. AAG's proprietary advantage loan may allow your clients to convert home equity into more loan proceeds than a traditional reverse mortgage – that’s the AAG jumbo reverse mortgage!

ReadRethink Reverse

We share your mission of putting the financial security of your customers first and can appreciate the hard work and attention to detail associated with balancing portfolio construction and risk management for long-term success. This booklet explores the use of home equity in retirement planning as an essential in balancing clients' short-term concerns with long-term goals.

ReadComplimentary Webinars for Financial Professionals

Join us at American Advisors Group for our latest complimentary webinars exclusively for financial professionals. Register today for these effective business building strategies and find out why the top financial advisors in the nation trust American Advisors Group.

Click on the links below to register.

Monetizing Home Equity to Benefit Clients and Your Business

With home equity representing the largest asset on many of your clients' balance sheets, doesn't it seem prudent to consider responsible and effective ways to include it in your plan design? Join us as we share solutions and case studies designed by advisors, for advisors, to uncover risk mitigation strategies you may not know exist. In this 60-minute CE approved session, we’ll discuss:

- Why home equity matters

- How home equity is being used by clients and their advisors

- Traps, hurdles, and hidden fees

- The impact on your business

A Case Study: Advanced Planning Strategies for Mass Affluent Baby Boomers with Housing Wealth

This webinar takes you on a deep dive into the “Brad & Heather Case Study” by walking participants through 30 years of retirement for a mass affluent family.

After taking the recommendation of their advisor to put a HECM Line of Credit in place, Brad and Heather are in a stronger financial position to address a wide range of potential challenges, needs, and opportunities in retirement:

- A downturn in their investment holdings

- A home renovation

- A downturn in real estate

- In-home care needs

- The death of a spouse

- The transition to the next generation

Through their story, we will highlight the specifics of how the strategic use of a HECM LOC can improve retirement for millions of Americans.

Watch NowHidden in Plain Sight: Relatively Unknown Home Equity Strategies for Retirement Planning

Join us for this informative session as we reveal the realities and math behind including home equity into retirement strategies. Specifically, we’ll illustrate case studies using the home equity conversion mortgage (reverse) in ways that most financial professionals haven’t seen. Perhaps one of the more unique and flexible tools available to you and your affluent clients, utilizing one of their more valuable assets, hiding right there in plain sight.

CFPs can earn CE credit by visiting aag.expert/CECredits after the webinar and paying the $4.95 processing fee.

Watch NowMeet the Team

Hank Sanders

Strategic Business Specialist, AAG

As a strategic business specialist for AAG, Hank specializes in education, supporting, and developing relationships with financial advisors.

Hank began his career in financial services as a financial consultant with Merrill Lynch, Pierce, Fenner & Smith in 1986. Just over one year into his career, Black Monday reset the entire industry’s perspective of investment risk and had a tremendous impact on Hank’s approach to serving his clients. Hank began to redefine his business, taking a holistic approach in designing comprehensive financial plans, investment solutions, and strategies based on the client’s prioritized goals for the one life they get to live, while targeting the least amount of risk necessary.

When he joined the team at AAG to educate industry professionals on the integration of housing wealth strategies into comprehensive planning for the mass affluent retiree, Hank knew he could have a great impact on the industry and, potentially, thousands of lives.

Ryan Ponsford

Strategic Business Specialist, AAG

Ryan has been involved in wealth management, real estate, business building, and philanthropy for over two decades.

From designing strategic solutions to some of our nation’s wealthiest families, creating business systems for rapidly growing companies, and founding and expanding Main Street Philanthropy, a non-profit organization, across the nation, his experience is extensive, yet built upon a repeatable set of core principles.

Ryan has been recognized as a thought leader, disrupter, and innovator in designing purpose-driven financial solutions that integrate illiquid assets, multi-generational wealth strategies, and inclusion of real estate into retirement solutions. With American Advisors Group, he leads a team specializing in designing solutions and education for financial professionals on how to effectively integrate home equity into retirement strategies.

David Brindley

Strategic Business Specialist, AAG

As part of the Alternative Distribution Channel and the Strategic Business Specialists Group at American Advisors Group (AAG), David develops business-to-business sales development and referral partnerships with financial planners.

David has worked in the reverse mortgage industry for more than 12 years, in both the retail and wholesale arenas, and has managed reverse mortgage business divisions for the past six. David’s more than three decades’ experience in the financial services industry includes 26 years in the fixed income sales and trading divisions of major investment banking companies. David received his B.A. in Business Administration from Southern Methodist University and the Cox School of Business. David and his wife reside in Denver, Colorado.

HECM Line of Credit vs. HELOC

In business, a line of credit can help protect and strengthen an enterprise in countless ways. Defensively, the owner can use it to help meet short-term capital needs or, proactively, to seize an offer simply too good to pass up. It automatically gives the business owner more options to nimbly and strategically meet almost any […]

Read MoreCall us today: (866) 680-8351

For industry professionals only – not intended for distribution to the general public.

AAG/American Advisors Group are divisions of Finance of America Reverse LLC which is licensed nationwide | Equal Housing Opportunity | NMLS ID # 2285 | 8023 East 63rd Place, Suite 700 | Tulsa, OK 74133

News & Updates

HECM Line of Credit vs. HELOC

In business, a line of credit can help protect and strengthen an enterprise in countless ways. Defensively, the owner can use it to help meet short-term capital needs or, proactively, to seize an offer simply too good to pass up. It automatically gives the business owner more options to nimbly and strategically meet almost any […]

Read More