Boost Your Buyers’ Purchasing Power with HECM for Purchase loans

Did you know homeowners 62 and up have over $7 trillion1 tied up in home equity? By incorporating HECM for Purchase loans into your business, you can open a new, growing market segment giving you the ability to close more deals on higher-value properties. The HECM for Purchase gives your buyers greater financial flexibility and control over the communities and homes of their dreams.

How It Works

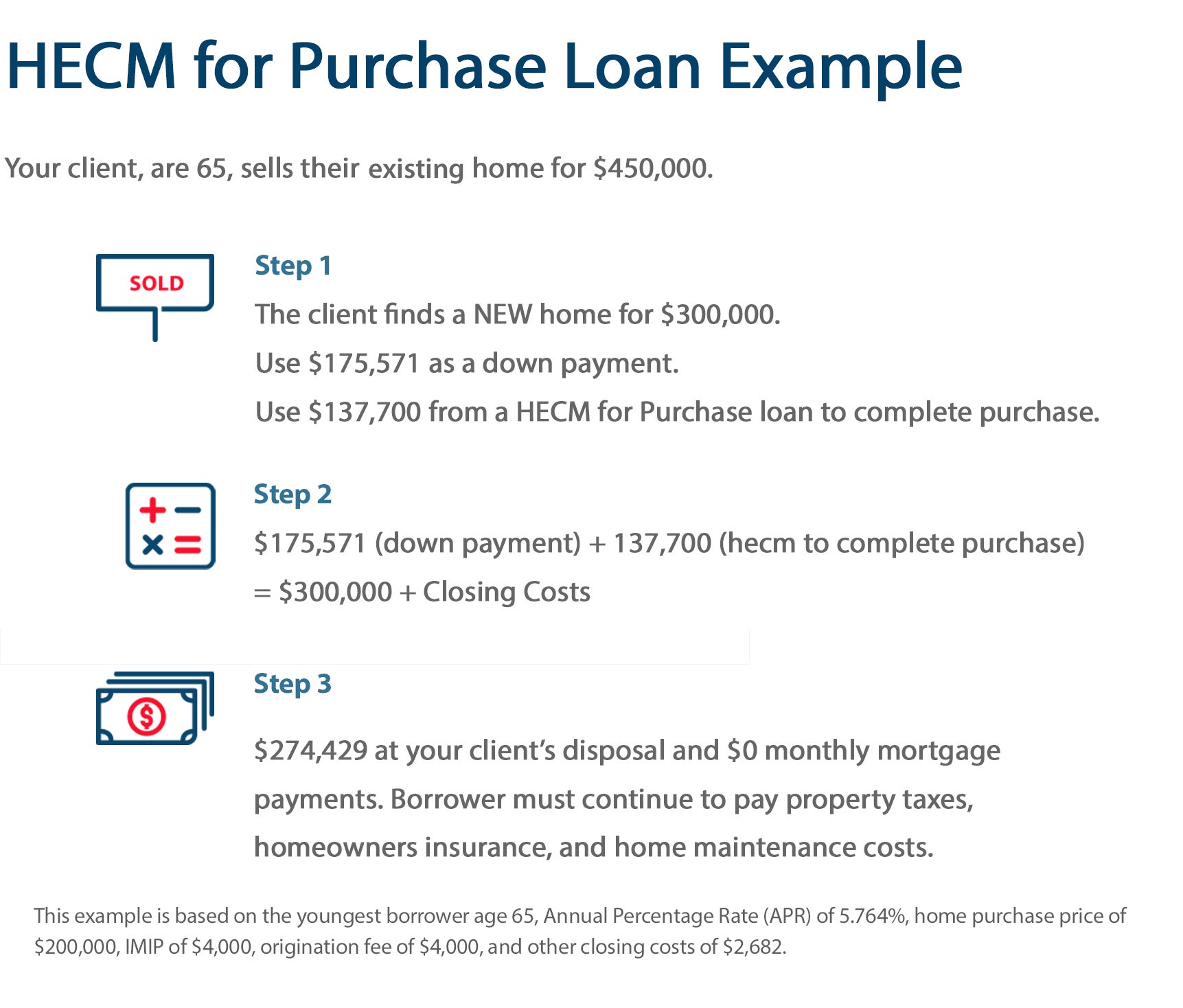

How a HECM for Purchase works is simple. Buyers, who must be 62 or older to participate, put down a portion (e.g. 60%) of the new home’s price, and the mortgage lender puts down the rest to complete the purchase. The lender’s portion, however, does not have to be repaid until the borrower leaves the home or does not otherwise comply with the loan terms. With no monthly mortgage payments to make, buyers may choose to use their added buying power to purchase a larger model or additional builder upgrades. Borrowers must continue to maintain the property, pay taxes and homeowners insurance, and otherwise comply with all loan terms.

The Impact on Your Business

- Enhance your company’s value proposition by offering more financial solutions.

- Boost your buyers’ purchasing power.

- Increase revenues and profits from more home sales.

What This Means for Your Buyers

- Increase their purchasing power to get the home they want.

- Buy a home right-sized with more of the age-appropriate amenities they prefer.

- Enjoy no monthly mortgage payments (borrower must continue to pay property taxes, homeowners insurance, and maintain the home).

More AAG Options: FHA, traditional, refinance, jumbo, jumbo reverse, reverse for purchase and jumbo reverse for purchase loans.

¹"Senior Housing Wealth Reaches Record $7.23 Trillion" - National Reverse Mortgage Lenders Association. April 3, 2020. https://www.nrmlaonline.org/about/press-releases/senior-housing-wealth-reaches-record-7-23-trillion

According to NAR, 1 in 5 home buyers today is over the age of 62. What if 20% of your buyers had 40% more purchasing power? By incorporating Home Equity Conversion Mortgage (HECM) for Purchase loans (exclusive to homeowners 62+) into your business, you can open a new, growing market segment, giving you the ability to close more deals on higher-value properties. See below to learn more.

HECM for Purchase Booklet for Builders

Learn how a HECM for Purchase loan can increase closings in your communities.

ReadHelp Build Sales in Your Communities

Give your senior clients more options! This flyer includes an example of how your buyers can use a HECM for Purchase loans to purchase your properties, allowing you to move more inventory.

Read

Senior Expert Jim Bland Conducts His Company the Right Way

Offering a Symphony of Services for Seniors Who Want to Age in Place Jim Bland is a special kind of conductor. Instead of directing the simultaneous performance of several players to bring a musical score to life, he is a multi-talented maestro who’s company provides innovative in-home fall prevention technologies and works with expert building […]

Read More

Increase Your Buyers’ Purchasing Power

Are you a builder or real estate professional with senior clients eager to move out of their current homes and into new ones — if only they could do it in such a way that they didn’t have to exhaust all or most of their home sale profits or retirement savings? If you have clients […]

Read MoreCall us today: (866) 680-2770

For industry professionals only – not intended for distribution to the general public.

AAG/American Advisors Group are divisions of Finance of America Reverse LLC which is licensed nationwide | Equal Housing Opportunity | NMLS ID # 2285 | 8023 East 63rd Place, Suite 700 | Tulsa, OK 74133

News & Updates

Senior Expert Jim Bland Conducts His Company the Right Way

Offering a Symphony of Services for Seniors Who Want to Age in Place Jim Bland is a special kind of conductor. Instead of directing the simultaneous performance of several players to bring a musical score to life, he is a multi-talented maestro who’s company provides innovative in-home fall prevention technologies and works with expert building […]

Read More

Increase Your Buyers’ Purchasing Power

Are you a builder or real estate professional with senior clients eager to move out of their current homes and into new ones — if only they could do it in such a way that they didn’t have to exhaust all or most of their home sale profits or retirement savings? If you have clients […]

Read More